Hong Kong’s new taxation regime for foreign-sourced income (Part 1)

This article is the first in a series providing an overview of Hong Kong’s new rules on the taxation of passive income and answers the “why”, “who”, and “what”.

This is a new area of law with no precedents yet and a complex subject matter. This article does not, and is not intended to, constitute legal advice, and should not be relied upon as such.

A new Hong Kong law has changed the rules of the game with regards to the taxation of specified income received by a Hong Kong company from overseas: the Inland Revenue (Amendment) (Taxation on Specified Foreign-sourced Income) Ordinance 2022, effective since 1 January 2023.

You may find this new legislation relevant if you have interest in a Hong Kong company with passive income from a permanent overseas establishment or subsidiary. Passive income may include interest, dividend, disposal gains or intellectual property income.

Why the new rules?

Back in 2021, Hong Kong was put on the European Union (EU) watchlist on tax co-operation. A thorough analysis of the Hong Kong tax regime based on the EU guidance on Foreign-sourced Income Exemptions (FSIE) identified a potential loophole, where companies in Hong Kong could receive overseas income which was neither taxable overseas nor in Hong Kong.

The new rules came into effect on 1 January 2023 to fully comply with the aforementioned EU guidance, which was published in 2019. However, since new EU guidance was published at the end of 2022, modifications are expected to be made to the rules for further alignment. The Hong Kong government plans to address this by the end of 2023, with effect from 1 January 2024. Meanwhile, Hong Kong remains on the EU watchlist on tax co-operation.

Who do the new rules apply to?

The new rules apply to international group holding companies, which are defined in many complementary (and complex) ways under the new section 15H of the Inland Revenue Ordinance (Cap. 112), namely:

- MNE;

- MNE entity;

- MNE group;

- stand-alone MNE;

- ultimate parent entity;

- controlling interest.

There are two approaches to applying these definitions.

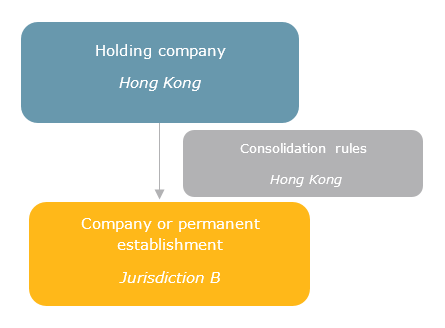

The first approach refers to any group with the following ownership chart:

The second approach involves determining whether the holding company in Hong Kong is required to consolidate its financial statements or not, according to the provisions of the Companies Ordinance (Cap. 622).

As an illustration, a small and medium-sized entity (SME) in Hong Kong that holds an overseas subsidiary but is exempt from preparing consolidated financial statements under the SME Financial Reporting Standard is not considered an MNE[1].

The concept of MNEs and their related terms which have been adopted by the new FSIE regime are modelled on those in the Global Anti-base Erosion Rules (GloBE Rules). These were published by the Organisation for Economic Co-operation and Development (OECD) under the Two-Pillar Solution[2] to address tax challenges arising from the digitalisation of the economy.

The new rules DO NOT apply to individuals, standalone local companies, and purely local groups.

What changes for MNEs with the new rules?

The following table clearly outlines the differences between taxation for specified income received by a Hong Kong company from an overseas company or permanent establishment (a) before 1 January 2023 and (b) from 1 January 2023 onwards. It accounts for the new Division 3A of the Inland Revenue Ordinance (Cap. 112) on “Specified Foreign-sourced Income”, which introduced new sections 15H to 15S and new schedules 17C, 54 and 55.

| Specified foreign-sourced income | Taxation in Hong Kong | (a) Before 1 January 2023 | (b) From 1 January 2023 | *Exemptions |

| Interest | No taxation | Taxation* | *Economic substance requirement |

| Dividend | No taxation | Taxation* | *Economic substance or participation requirement |

| Disposal gains[3] |

No taxation | Taxation* | *Economic substance or participation requirement |

| Specified Intellectual Property Income | Taxation | Taxation* | *Nexus requirement |

Excluded from the new rules are foreign-sourced income accrued by regulated financial entities (e.g., insurance companies and banks) and income derived from doing business as a regulated financial entity. The same applies to entities covered under a preferential tax regime, such as shipping and aircraft leasing companies.

Takeaway

As a result of the new tax rules since 1 January 2023, specified income received by international group holding companies (MNEs) in Hong Kong are taxable, unless the MNEs meet the conditions for exemptions.

The crux of the new tax regime lies in the exemptions which introduce the requirements of economic substance, participation, and nexus aligned with EU tax guidelines and OECD BEPS definitions. Read Part 2 of this article series to dive into the details of the economic substance requirement.

[1] Report, Hong Kong Institute of Private Accountants, December 2015.

[2] OECD/G20 brochure of October 2021 on Base Erosion and Profit Shifting Project: Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy.

[3] Disposal gain means any gain or profit derived from the sale of equity interests in an entity (new section 15H of the Inland Revenue Ordinance (Cap. 112), interpretation provisions).