Sharing profits is an essential aim of most companies. This article explains how and when it can be achieved, and highlights the similarities between rules applicable to French and Hong Kong companies.

Excepting start-ups, for which the measure of success may be different, most companies strive for profit[1]. Directors, shareholders and auditors need to be aware of the laws governing dividend distribution, in order to make valid decisions where the practice is considered. In France and Hong Kong, similar rules govern the distribution of dividends by companies. This article presents them in a concise manner, illustrated by charts.

To avoid getting lost in the details of the different types of commercial companies that can be formed in France, for the purpose of this article, we’ll use the example of a form of private company limited by shares, called a société par actions simplifiée (SAS), which is subject to French corporate tax (impôt sur les sociétés, or IS). In Hong Kong, which has only one form of legal entity for companies, we’ll use the example of a private company limited by shares. In addition, let’s assume that the financial year end for both companies is 31 December and the articles of association do not contain derogatory provisions.

Definitions

C com: the French Commercial Code

CO: the Companies Ordinance, Chapter 622 of the Laws of Hong Kong

Distributable profit:

- In France, distributable profit is the profit for the financial year minus previous losses as well as the sums to be allocated to reserves, in accordance with the law or the articles of association, together with any retained earnings.

- In Hong Kong, distributable profits are a company’s accumulated realised profits (to the extent that they have not previously been utilised by distribution or capitalisation) less its accumulated realised losses (to the extent that they have not previously been written off in a reduction or reorganisation of capital) (as defined in section 297(2) CO). It should be noted that accumulated realised profits include the distributable reserves of the company.

Dividend: a payment made by a company to its shareholders when it makes a profit

Hong Kong: the Hong Kong Special Administrative Region of the People’s Republic of China

Procedures for the distribution of dividends

The decision to distribute dividends after the end of a financial year

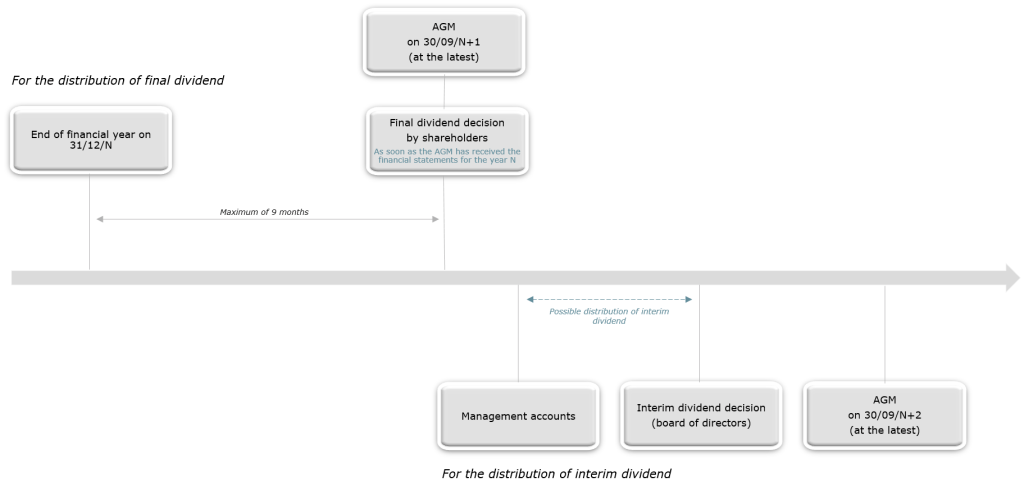

| In Hong Kong

Governed by the CO and a company’s articles of association, the distribution of dividends is generally decided at the annual general meeting (AGM): this is known as a final dividend. According to the model articles of association for private companies in Hong Kong,[2] the procedure is as follows: » The directors of the company recommend an amount to be distributed. » Dividends are approved and declared by the shareholders at the company’s AGM. » The amount is determined based on the audited financial statements and must be paid out of the distributable profits;[3] the amount cannot be higher than the directors’ recommendation. » Once the final dividend payment is approved by the shareholders, this declaration gives rise to a debt owed to the beneficiary shareholders. Unless exempted under the CO, a company must hold an AGM within nine months of the end of the financial year. |

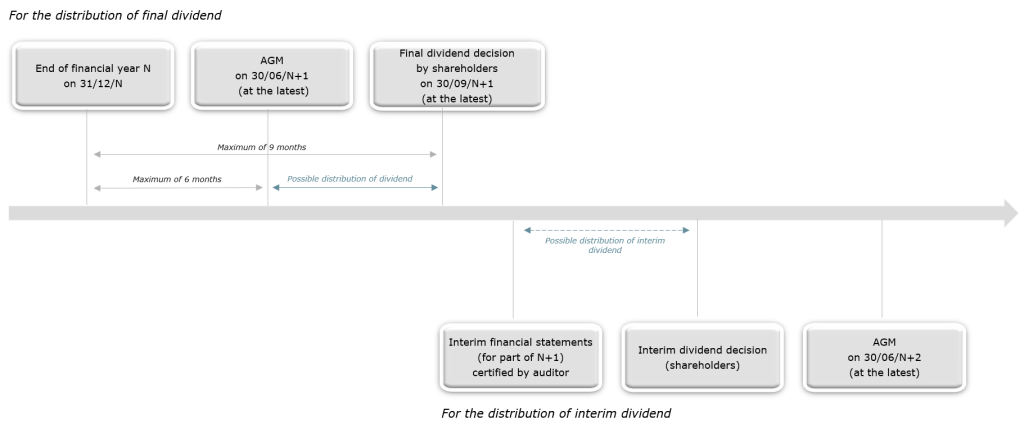

In France

As in Hong Kong, in France the distribution of dividends is subject to the approval of the last financial year’s accounts, which must show a distributable profit.[4] Dividends are decided at a company’s AGM or a subsequent general meeting (which must be held within nine months of the financial year end[5]). At the general meeting, shareholders may also decide to distribute sums taken from the reserves at their disposal. However, dividends must be taken in priority from the distributable profit of the financial year.[6] Failure to comply with the nine-month deadline for payment of dividends constitutes a fault on the part of the directors, who are liable individually or jointly and severally, as the case may be, to the company or to third parties, either for offences against the applicable legislative or regulatory provisions, for breaches of the articles of association, or for faults committed in their management.[7] |

The possibility of paying interim dividends in respect of a current financial year

| In Hong Kong

Interim dividends can be distributed at any time of the year and as many times as required, provided there are sufficient distributable profits for the current year. The decision to distribute interim dividends is based on unaudited interim accounts (i.e., management accounts)[8]. According to the model articles of association for private companies in Hong Kong,[9] a company’s directors retain the sole discretion to decide whether distributing interim dividends is justified by sufficient profits. It is therefore common for interim dividends to be distributed without holding a general meeting. Unlike with final dividends, the decision to pay interim dividends does not create an immediately payable debt for the company. As long as no payment has taken place, the directors can reverse their decision and decide not to pay interim dividends.[10] The shareholders cannot demand payment of interim dividends even if they have already been declared.[11] |

In France

Distribution of interim dividends can take place either during the financial year (most common), or after the end of the financial year but before the approval of the annual financial statements. If a company wants to distribute interim dividends, interim accounts must be prepared during the financial year. They must[12]: » be certified by an auditor; and » show that the company has made a distributable profit so far for the ongoing financial year. The decision is taken by the shareholders in meeting or in writing. The distributable profits so far for the ongoing financial year is the cap for the interim dividends. |

Charts: The distribution of dividends process

In France

In Hong Kong

Unlawful distribution of dividends

| 1 | Hong Kong

In Hong Kong, it is unlawful to distribute dividends where there has been a failure to comply with:

|

In case of the unlawful distribution of dividends:

|

| 2 | France

Any dividend distributed without complying with the conditions of approving the accounts, followed by recognition of a distributable profit, constitutes an unlawful distribution of dividends.[15] In addition, any interim dividend paid in excess of net profits recognised constitutes an unlawful distribution of dividends. |

In case of the unlawful distribution of dividends:

|

Conclusion

In short, there is plenty of common ground between France and Hong Kong, when it comes to the distribution of corporate dividends. The words of Deputy High Court Judge Le Pichon in the June 2021 case referred above (note 8) are relevant to both jurisdictions:

[55] The company’s accounts are of critical importance for any dividend distribution: this is because, as earlier noted, the financial items that such financial statements must contain constitute the reference point for the distribution of dividends.

Unsurprisingly, a far greater difference between France and Hong Kong legislations exists when it comes to tax on dividends. This important topic will be the subject of our next article.

[1] In its latest version, article 1832 of the French Civil Code states (underlined by us):

“A company shall be formed by two or more persons who agree by a contract to allocate assets or their industry to a common enterprise with a view to sharing the profit or benefiting from the economy which may result from it.

It may be established, in the cases provided for by law, by the act of will of a single person.

The partners shall undertake to contribute to the losses.” [Note: for companies with limited liability, this contribution is limited by shares (i.e., the liability is limited to the consideration for the shares) or by guarantee (in Hong Kong) (i.e., the liability is limited to an undertaking to pay an amount determined in advance).]

[2] Art 73(3), Sched 2, Companies (Model Articles) Notice (Cap 622H).

[3] S 297(1), CO.

[4] C com, Art L232-12.

[5] C com, Art L232-13, al 2.

[6] C com, Art L232-11, al 2.

[7] C com, Art L225-251 and Art L227-1, al 3.

[8] This requirement was unambiguously spelt out in the recent case of Chan Ka Ching v AJS Co – [2021] HKCU 3109 made on 21 June 2021, where the payment of “monthly dividends” on the basis of Excel spreadsheets of income and expenses (“cash flow tables”) was declared unlawful and the members liable to repay the distributions in application of section 301 of the CO.

[9] Art 73(2), Sched 2, Companies (Model Articles) Notice (Cap 622H).

[10] Lagunas Nitrate Co Ltd v Schroeder & Co [1899] 2 Ch 392; Marra Developments Ltd v BW Rofe Pty Ltd [1977] 2 NSWLR 616; Brookton Co-operative Society Ltd v Commissioner of Taxation (Cth) (1981) 147 CLR 441; [1981] HCA 28.

[11] Potel v Inland Revenue Commissioners [1971] 2 All ER 504.

[12] C com, Art L232-12, al 2.

[13] S 297(1), CO.

[14] S 301, CO.

[15] C com, Art L232-12, al 3.

[16] C com, Art L244-1.

[17] C com, Art L232-17.

The law in this respect is complex. The information provided in this article does not, and is not intended to, constitute legal advice and should not be relied upon as such.

For professional legal advice, please do not hesitate to contact us.