Share buy-backs are a versatile corporate tool used by companies to manage capital structure, facilitate shareholder exits and optimise share ownership. Whether the aim is to simplify the capitalisation table, repurchase the shares of a departing employee, founder or shareholder, or return surplus capital to shareholders, buy-backs offer a flexible mechanism to achieve these objectives.

In Hong Kong, share buy-backs are governed by the Companies Ordinance (Cap. 622) (CO), which provides for several financing methods and imposes specific procedural requirements.

This article provides a practical overview of the available share buy-back routes for private companies limited by shares in Hong Kong, as well as the procedural steps for implementation, to help ensure compliance.

The law in this respect is complex. While this article is meant to inform, it doesn’t constitute legal advice and shouldn’t be treated as such. If you’d like tailored guidance on share buy-backs, Slotine is here to help. Please contact us if you wish to learn more about this.

STRATEGIC USES OF BUY-BACKS

For private companies, share buy-backs can serve several strategic purposes:

- facilitate a shareholder’s exit – buy-backs provide a clean and controlled mechanism for early investors or founders, amongst others, to exit;

- return surplus capital to shareholders;

- manage capitalisation table complexity – a buy-back reduces the number of shareholders and can simplify governance and decision-making, or be used to simplify a group’s structure;

- support employee incentive schemes – if the incentive plan contains adequate provisions, a buy-back can be used to repurchase the shares of a departing beneficiary and achieve a clean cut.

PRELIMINARY VERIFICATIONS

To buy back its own shares, a company must go through the following checklist:

- review its articles of association to ensure share buy-backs are permitted;

- verify that the shares that are proposed to be bought back are fully paid; and

- verify that the remaining shares after completion will not only consist of redeemable shares.

AVAILABLE SHARE BUY-BACK ROUTES IN HONG KONG

Under the CO, there are three ways of financing a share buy-back:

- out of distributable profits: if the company has sufficient accumulated distributable profits (as defined under the CO), it may use those profits to pay for the buy-back;

- out of proceeds from a fresh issue of shares: the company may issue new shares to raise funds specifically to finance the buy-back;

- out of share capital: if the company doesn’t have sufficient distributable profits to finance the buy-back, it may reduce its share capital amount. However, this route is only available if the company satisfies the statutory solvency test, which entails the company being able to pay its debts at the time of the buy-back, and remaining able to pay its debts as they fall due during the 12-month period immediately following the buy-back.

Upon completion of the buy-back, the shares are transferred to the company and immediately and automatically cancelled. The impact on the share capital depends on the share buy-back route:

- for a buy-back out of distributable profits or proceeds from a fresh issue of shares, the number of shares is reduced but the share capital amount isn’t affected;

- for a buy-back out of capital, the number of shares is reduced, and the share capital amount is reduced proportionally to the buy-back amount.

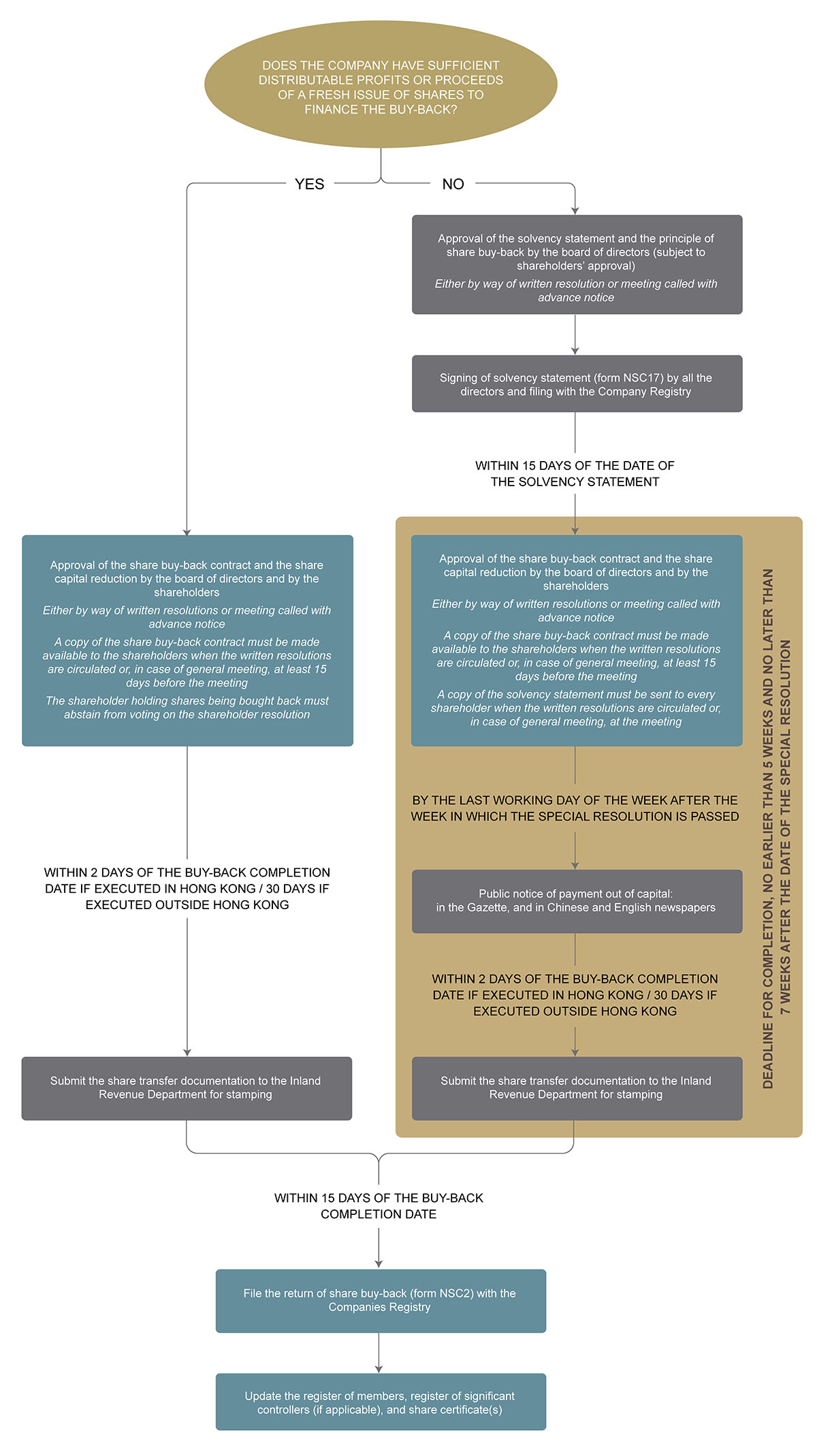

STEP-BY-STEP IMPLEMENTATION

TAX CONSIDERATIONS

TAX CONSIDERATIONS

Share buy-backs are treated as standard share transfers and are subject to stamp duty in Hong Kong. Stamp duty is levied at the rate of 0.2% on the higher of (i) the buy-back consideration or (ii) the net asset value of the shares being bought back. Share transfer documents (including but not limited to instrument of transfer, bought and sold notes, latest audited financial statements and management accounts made up to a date within the three-month period preceding the buy-back) must be submitted to the Inland Revenue Department for stamping:

- within two days of completion if the share buy-back is executed in Hong Kong; or

- within 30 days of completion if the share buy-back is executed outside Hong Kong.

Hong Kong doesn’t impose capital gains tax. However, the share buy-back may result in capital gain tax consequences if the seller is based overseas in a jurisdiction that levies capital gain tax. Overseas sellers should proactively assess the tax implications in their jurisdiction of residence, based on local tax rules, the existence of a double taxation agreement with Hong Kong, and the availability of tax credits or exemptions. Such tax questions may be quite sophisticated and require expert advice, particularly if the shareholder being bought back is a company.

KEY TAKEAWAYS

- To assess whether a company can buy-back its own shares, prior verifications must be carried out by reviewing the articles of association and assessing whether the shares concerned are fully paid, and whether the remaining shares after completion will be redeemable shares;

- The buy-back may be funded either out of distributable profits or proceeds from a share issuance, or out of capital, provided that the company satisfies the statutory solvency test;

- The implementation process depends on the financing method chosen, with strict procedural requirements applicable in any event, including statutory filings, deadlines and stamping obligations; and

- The company’s officers and management should clearly communicate about the transaction with the company secretary, accountant and auditors to ensure it is appropriately reflected in the company’s books and records.

HOW WE CAN HELP

We regularly guide private companies through every stage of share buy-backs in Hong Kong. From initial feasibility analysis to post-completion formalities, we provide strategic advice to ensure a smooth and compliant transaction. Our team serves as a trusted partner to founders, shareholders and executives, offering support on share buy-backs, exit strategies, share capital reductions and sophisticated group restructures. We collaborate with a network of trusted correspondents when tax advice is required in other jurisdictions.

Don’t hesitate to get in touch to connect with our team. We are happy to arrange an introductory meeting at your convenience, either in person over coffee at our office or by video conference.