Fermer une société solvable : liquidation ou radiation (en anglais)

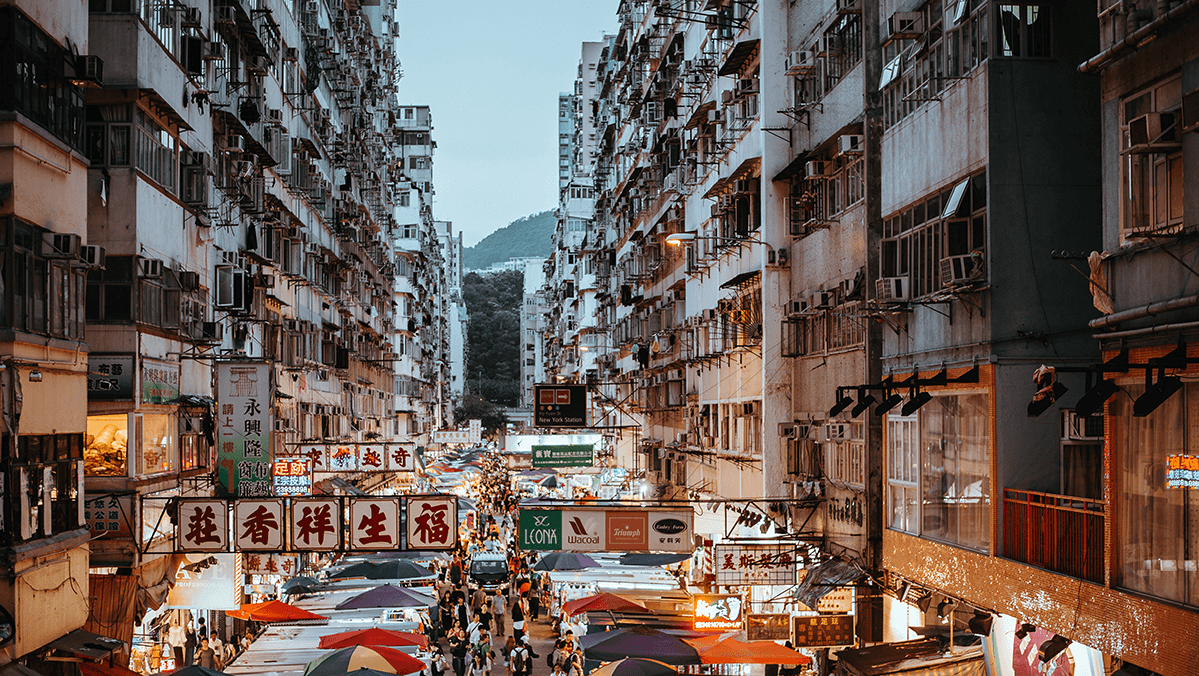

Slotine explique les tenants et aboutissants des procédures de dissolution d’une société solvable à Hong Kong : liquidation par les actionnaires ou radiation.

Slotine explains the nuts and bolts of the two routes towards closing down a solvent company in Hong Kong: members’ voluntary winding-up and deregistration.

When a private company limited by shares is solvent, there are two main routes towards dissolution: voluntary winding-up or deregistration. Provided that the company’s latest audited financial statements are available and that proper accounting records have been kept, both procedures are usually completed between 6 to 12 months. The fact that the company has a clean balance sheet with no outstanding liabilities tips the balance in favour of the deregistration route.

The winding-up procedure consists of the appointment of a liquidator in charge of settling the company’s liabilities and collecting its assets in order to settle its debts and distribute any remaining sums to the shareholders. The procedure is started by a special resolution passed by at least 75% of the shareholders after the directors have investigated the company’s affairs and confirmed that they are satisfied that the company will be able to pay its debts within the 12-month period after the company is put into winding-up. The shareholders must appoint an insolvency practitioner (usually a solicitor or certified public accountant) as liquidator and fix its remuneration. The costs and expenses of the winding-up, including the liquidator’s fees, are paid out of the company’s assets. However, the liquidator will usually require the shareholders who receive a surplus after the payment of all the creditors to keep him/her indemnified against any legal actions, claims and costs arising out of the winding-up. Considering the fact that the creditors are meant to be paid in full, they have no say in this procedure.

Deregistration is initiated by the shareholders acting unanimously. The procedure requires the company to never have started business or to have ceased business for more than three months. If the company has commenced business, deregistration is only possible if all assets have been collected and all liabilities have been settled. Considering the procedure only involves an application for a letter of no objection with the Inland Revenue Department and the filing of the application with the Companies Registry, it is more cost effective than members’ voluntary winding-up. However, if it appears that some creditors have not been repaid in full once the company is dissolved, the creditors can apply to the court for the company to be reinstated within 20 years of the deregistration.

The steps laid out in this article are by no means exhaustive but simply serve to bring clarity to the process of members’ voluntary winding-up and deregistration.

Read our articles outlining the steps and stakeholders of compulsory winding-up (by the court) and creditors and directors’ voluntary winding-up (when the company is insolvent).

DOWNLOAD PDF >

The steps involved in MEMBERS’ VOLUNTARY WINDING-UP

- List of assets and liabilities: The directors will establish a list of assets and liabilities based on up-to-date accounting records and financial statements.

- Board meeting: Approval of the issuance of a certificate of solvency containing a statement of the company’s assets and liabilities confirming that, in the directors’ opinion, the company will be able to pay its debts in full within 12 months and convene a general meeting (simple majority).

- General meeting: Approval of the winding-up by special resolution (75% majority), appointment of the liquidator and determination of their remuneration by ordinary resolution (simple majority). Within 5 weeks of issuing the certificate of solvency

- Formalities: Filing of the winding-up resolution, certificate of solvency and notice of appointment of liquidator with the Companies Registry and advertisement of notices of winding-up and appointment of liquidator in the Gazette. Within 15 days of general meeting

- Tax clearance and realisation of assets: Application for tax clearance by the liquidator (processing time 3-6 months), realisation of the company’s assets and payment of the creditors.

- Annual General meeting: If the winding-up continues for more than a year, the liquidator convenes an annual general meeting on the anniversary of the commencement of the winding-up to present an account of the winding-up to shareholders

- Notice of final general meeting: Once the affairs of the company are fully wound up, the liquidator convenes a final general meeting by advertisement in the Gazette. At least 1 month before meeting

- Final meeting of shareholders: Final general meeting at which the liquidator presents the account of the winding-up to the shareholders – showing how it has been conducted and how the property has been disposed of.

- Formalities: Filing of a copy of the winding-up account and a return of general meeting with the Companies Registry (if a quorum was not present at the meeting, the liquidator must file a return that the meeting was duly summoned and that no quorum was present). Within 1 week of general meeting

- Dissolution: Dissolution of the company. 3 months after filing with Companies Registry

What happens after the members’ voluntary winding-up process begins

The winding-up is considered to start on the date when the shareholders pass the special resolution approving the winding-up of the company. From that date:

- The company must stop carrying on business, except as required for the benefit of the winding-up.

- Every invoice, purchase order or letter issued by the company must state that the company is being wound up.

- Any transfer of shares made without the sanction of the liquidator is void.

- The powers of the directors will end upon the appointment of the liquidator, except if sanctioned by the liquidator or the shareholders in general meeting.

The stakeholders: roles and responsibilities

Directors

- Must maintain proper accounting records and up-to-date financial statements to assess whether the company is solvent.

- Sign the certificate of solvency accompanied by a statement of the company’s assets and liabilities.

- May be held liable under the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) (CWUMPO) if the company is unable to pay its debts in full within the 12-month period following the commencement of the winding-up procedure.

- May be held liable for breach of duties, fraud or lack of fitness under the Companies Ordinance (Cap. 622) and for unfair preference, undervalue transactions, fraudulent trading and failure to keep proper books and records under the CWUMPO.

Shareholders

- Approve the placement of the company into winding-up by special resolution passed by a majority of at least 75% of voting rights.

- Appoint one or more liquidators and determine their remuneration by ordinary resolution passed by a simple majority of the voting rights.

- Sanction certain acts of the liquidators such as any payment of a class of creditors in full or the making of a compromise or arrangement or creditors.

- If the winding-up continues for more than a year, are presented an account of the winding-up each year.

- Approve the winding-up account prepared by the liquidator.

- May be held liable to pay any amount unpaid on their shares to the company (but no more).

Liquidator

- Realises the company’s assets and distributes the proceeds to the creditors.

- Investigates the affairs of the company and its directors.

- Convenes a general meeting on the anniversary of the commencement date of the winding-up to present an account of the winding-up to the shareholders.

- If the liquidator forms the opinion that the company will not be able to pay its debts in full within the 12-month period following the commencement of the winding-up, they must summon a creditors’ meeting within 28 days from the day they formed that opinion and present a statement of affairs. The procedure automatically becomes a creditors’ voluntary winding-up on the day of the creditors’ meeting.

- Convenes a final general meeting to present the final account of the winding-up and sends a copy to the Companies Registry for the company to be dissolved.

The steps involved in deregistration

Before seeking approval from the shareholders for the deregistration of the company, the board of directors must verify that:

- the company has never started business or has ceased operation for more than three months;

- the company has no outstanding liabilities;

- the company is not a party to any legal proceedings; and

- the company does not own any immovable property in Hong Kong, either directly or via any subsidiary.

Provided that the conditions listed above are met, the deregistration must be approved by all the shareholders acting unanimously.

Once the shareholders’ approval is obtained, the steps towards deregistration are as follows:

- the company must prepare final financial statements up to the date of cessation of business and have them audited by a certified public accountant;

- the company must clear all its tax obligations: pay its business registration fee, file all its tax returns and pay any profits tax;

- the company must apply with the Inland Revenue Department (IRD) for a notice of no objection to the deregistration by filing a form 1263;

- after receiving the written notice of no-objection from the IRD (usually within 21 days provided that tax has been cleared), the company must apply for deregistration with the Companies Registry: the Companies Registry will publish a notice of deregistration in the Gazette informing third-parties that, unless an objection is received within three months from the date of the notice, the company will be deregistered;

- after the expiry of the three-month objection period, the Companies Registry will send a notice of deregistration to the company and publish a notice of deregistration in the Gazette. The company is then dissolved.

When the company is dissolved, all its property is given to the Hong Kong Government. Any person interested in a property or right granted to the Government may apply to the Companies Registry to object to the Government’s title within three years from the date of the dissolution. A former director, shareholder or creditor of the deregistered company may apply for restoration within 20 years after the date of dissolution if the company was in operation at the time of deregistration. A restored company will be regarded as if it had never been dissolved.

The law in this respect is complex. The information provided in this article does not, and is not intended to, constitute legal advice and should not be relied upon as such.

For professional legal advice, please do not hesitate to contact us.